| .

|

Se.

In the News

Communities

in Crisis: Pushed Beyond the Economic Limit

Contact: Stephen M.

Apatow

Founder,

Director of Research & Development

Humanitarian

Resource Institute (UN:NGO:DESA)

Humanitarian University

Consortium Graduate Studies

Center

for Medicine, Veterinary Medicine & Law

Phone: 203-668-0282

Email: s.m.apatow@humanitarian.net

Internet: www.humanitarian.net

United

Nations Arts Initiative

Arts Integration Into Education

Url: www.unarts.org

Twitter: unarts

In the Spotlight

- Miller tells Congress: Loan crisis just starting (Des Moines Register, 3 November

2007):

Iowa's attorney general testified Friday

before the U.S. House Committee on Financial Services.Miller testified

before

the U.S. House Committee on Financial Services. "We are at the

beginning

of this foreclosure crisis, not in the middle, and certainly not at the

end,"

he said.

- New York Sues First American Unit In Probe of

Home-Loan

Appraisal (Wall

Street Journal, 2 November 2007): Appraisers' complaints about pressure

to inflate property values have risen, studies suggest. In a survey of

1,200 real-estate appraisers released this year, 90% reported being

pressured by real-estate agents, lenders, mortgage brokers and

consumers to adjust property values in order to allow deals to go

through, up from 55% in 2003, according to October Research Corp., of

Richfield, Ohio.

- Inflated home appraisals? Rings a bell (2 November

2007):

New York Attorney General Andrew Cuomo is charging Washington Mutual

and

a major real-estate appraisal firm with inflating home values

nationwide.

Bob Moon reports Marketplace looked into this -- over two years ago.

In

The News

Center For Responsible Lending: From 1998 to 2006, subprime lending

enabled 1.44 million people to become first-time homeowners -

but it led

to 2.37 million foreclosures, a net loss of nearly 1 million,

the

center reported.Set

up for a fall, New York Daily News, 28 March 2007.

Mr Dodd accused the Fed of being aware three years

ago that lending standards were slipping amid the credit boom fueled by

historically low interest rates. Yet the central bank encouraged the

spread

of precisely the sort of adjustable mortgages whose rates are now

jumping

higher, forcing overstretched borrowers into default and foreclosure. --

Fraudulent

lenders blamed for US crisis, Belfast Telegraph, 23 March 2007.

--

“This

rate is nearly double the projected rate of subprime loans made in

2002,

and it exceeds the worst foreclosure experience in the modern mortgage

market,

which occurred during the “Oil Patch” disaster of the 1980s. -- Losing

Ground: Foreclosures in the Subprime Market and Their Cost to Homeowners,

Center for Responsible Lending, 19 December 2006.

Overview

Recently,

I had the opportunity to hear about senior citizens who are facing

unsustainable

economic challenges, that include loosing their homes. The recent

hyperinflationary

period (Wickpedia: U.S. Housing Bubble) has

encompassed

a focus to exploit vulnerabilities, and in the context of senior

citizens,

the trend appears to be in full swing.

While the U.S. housing market has now prompted a foreclosure crisis (Millions of foreclosures loom, NPR, 2 February

2007),

realtors in many regions are positioning

offers to purchase foreclosures that cannot be moved by the banks, at

70%

of today's inflation adjusted Fair

market Value (price to sell in today's market):

Wickpedia:

The definition of "fair market value" is found (in the specific context

of U.S. tax law) in the United States Supreme Court decision in the

Cartwright case:

The fair market value is the price at which the

property would change hands between a willing buyer and a willing

seller, neither being

under any compulsion to buy or to sell and both having reasonable

knowledge of relevant facts.[1]

[1] United States v. Cartwright, 411 U. S.

546, 93 S. Ct. 1713, 1716-17, 36 L. Ed. 2d 528, 73-1 U.S. Tax Cas.

(CCH) ¶ 12,926 (1973) (quoting from U.S. Treasury regulations

relating to Federal estate taxes, at 26 C.F.R. sec. 20.2031-1(b)).

Fair Market Value of homes across

the

United States are being adjusted to price that would facilitate sale

in current market conditions TODAY (abundant available properties,

including

foreclosures). For specific market information:

-- Zillow.com:

Real

Estate Valuations Online: Search by Address, Street or

Neighborhood,

City, State or ZIP.

-- Foreclosures.com:

Search by State, County or Zip Code: Listing of Foreclosures,

Preforeclosures,

Bankruptcies, FSBOs, Tax Liens.

-- RealtyTrac.com:

Search Foreclosures by City & State or Zip. Listing of

Pre-Foreclosure,

Auction, Bank Auction, For Sale by Owner, Resale Homes.

|

But while this transition is taking place in many regions of the United

States, municipalities continue to reference hyperinflated housing

prices

in reassessments, placing an unsustainable burden on senior citizens, a

burden

that in some cases will force them to loose their homes.

But, as the Appraisal Institute

recently

testified to Congress, appraisers are under increasing pressure from

lenders,

mortgage bankers and real estate agents to "hit their number" when

appraising

property

Rather than come up with an independent estimate of a home's value,

appraisers

-- who are typically independent contractors -- say they are being told

to

base their estimate on a predetermined value.

The problem is so widespread, that more than 8,000 appraisers – roughly

10 percent of the industry – have signed a petition asking the federal

government to take action.

-- Appraisal fraud: your home at risk: Appraisers say

they're

being pressured by lenders to inflate their estimates of home values,

CNNMoney,

2 June 2005

See

also: Financial Crimes to the Public: FBI 2005 Report -

Mortgage

Fraud.

|

Meanwhile,

municipal, state and federal programs are being asked to coordinate

initiatives

to soften the systemic challenges associated with this unprecedented

hyperinflationary

period. As some of the most vulnerable in our communities, the

needs

of senior citizens must be prioritized.

Resources:

-- American Bar

Association

Commission on Law and Aging: The ABA Commission on Law and Aging

(COLA)

is dedicated to examining law and policy issues affecting older

persons.

--

National Senior Citizens

Law

Center advocates before the courts, Congress and federal agencies

to

promote the independence and well-being of low-income elderly and

disabled

Americans.

-- Consumer Facts for Older Americans: Consumer

Law

Center.

-- SeniorLaw:

Elder Law & Legal Resources on the Web.

US

Federal Reserve Sets Up Crisis Center

In the Spotlight

- One Fix Too Many: John H. Makin, American

Enterprise

Institute, Monday, October 29, 2007.

- Central bankers got us in this mess, Financial

Times,

14 October 2007.

- What are offshore derivatives instruments?, The

Economic

Times, 18 October 2007.

- Worst Housing

Crisis Hits Since Great Depression, Real Estate News, 15 October

2007.

- Zimbabwe's Inflation Rate At Nearly 8000 Per Cent,

AHN, 17 October 2007)

Contingency

planning and risk management discussions are gaining momentum on the UN finance ministerial level.

[See: Contingency Planning: Year 2000 Conversion Global

Infrastructure

Analysis: Humanitarian Resource Institute.]

The

latest report by the International Swaps and Derivatives Association

(ISDA) shows that the total outstanding volume of all over-the-counter

credit derivatives increased from $US 3.5 TRILLION in 1990 to $US 63

TRILLION in 2000 and to over $US 283 TRILLION this year. The total

amount of exchange-traded and over-the-counter

structured financial instruments was 27.3 percent of global GDP in

1990.

This year it is 772.8 percent. The BIS has reported that the global

market

for derivatives has soared to a record $US 370 TRILLION in the first

half

of 2006, boosted by credit default swaps. - CurrentConcerns.ch:

November Issue, 2006.

[Note: 2007 Derivatives discussion encompasses $US 750 Trillion.]

In

January of 1959, the first date in this data series, the money supply

stood

at $292 billion. By February of 2006, it had grown 3,419 percent to

$10,276

billion. Since 2000 the money supply has grown 55 percent and it has

grown

by $764 billion in the just last twelve months.On March 23, 2006,

the

Board of Governors of the Federal Reserve System ceased publication of

the

M3 monetary aggregate and its components. -- M3 Money

Stock: Board of Governors of the Federal Reserve System:

The

derivatives challenge

(Financial

Policy Forum) is now in the spotlight, Hedge-Fund Borrowing is now being Examined by Fed, SEC

and

European Regulators (Bloomberg, 8 January 2007) and as noted the

following

article (US Fed Sets Up Crisis Center, FN Arena, 12 january

2007),

the US Federal Reserve is setting up a crisis center.

Senate Budget Committee, 18 January 2007: Federal Reserve Chairman Ben

Bernanke was asked when measures would need to be implemented to avoid

a catastrophic economic impact in the United States, his answer was 10

years ago. His

bottom line (Bernanke

warns of impending fiscal crisis, Times UK, 18 january 2006):

"We are experiencing what seems likely to be the calm before the storm."

Consumer Debt: Families In

Crisis

Bankruptcy Statistics: American Bankruptcy Institute

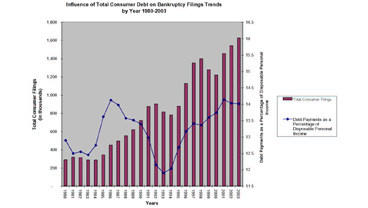

Influence

of Total Consumer Debt on Bankruptcy Filings

Trends by Year 1980-2005 - Statistics

Resources: American Bankruptcy Institute (ABI)

|

|

.

.

.

|

|