|

Protecting America's Families: Predatory Lending

Contact: Stephen M.

Apatow

Founder,

Director of Research & Development

Humanitarian

Resource Institute (UN:NGO:DESA)

Humanitarian University

Consortium Graduate Studies

Center

for Medicine, Veterinary Medicine & Law

Phone: 203-668-0282

Email: s.m.apatow@humanitarian.net

Internet: www.humanitarian.net

United

Nations Arts Initiative

Arts Integration Into Education

Url: www.unarts.org

Twitter: unarts

Background

As

the real

estate market is credited for the rapid economic recovery, consumers

turned

homes into ATM's. Cash borrowed against home equity from 1990

through

1998 was calculated in the average range of 50 billion per year in

contrast

with the period from 1998-2002 where this figure rocketed to

approximately 300 billion per year. The time period from 1995-02

encompassed over a 33 percent real increase in house prices in contrast

with the boom periods of 1975-79 (approx. 17 percent) and 1982-1989

(approx. 18 percent). --

Jeff Rubin, CIBC World Markets, May 2003.

Conventional

loans to low-income buyers leapt 75 percent between 1993 and 1998.

Minority buyers increased at a pronounced rate, with blacks seeing 95

percent growth and Hispanics 78 percent. This growth in lower-income

and minority homebuyers helped fuel the ascent of the subprime mortgage

market, which grew at an eye-popping 880 percent. -- Predatory Lending: A Special Issue, Shutting the Door

on Abusive

Mortgage Practices: Bridges,

2001, The Federal Reserve of St Louis.

What

federal, state and municipal protections will be provided for

consumers, if real estate valuation is found to have been artificially

inflated, to an extent proportional to accounting irregularities that

fueled the stock market crash in 2002?

The Big Picture

Falls in world-wide

equity markets during 2000-2002 saw markets decline by US$13 trillion

or

US$2,000 for every man, woman, and child on the planet according to ABN

AMRO’s

Global Investment Returns Yearbook, a study of long-term investment

returns

by Elroy Dimson, Paul Marsh and Mike Staunton from London Business

School.

-- New research report finds stock market losses total

US$13 trillion since 2000.

A few

statistics to consider from "The

Ultimate Objective"

- The wealthiest fifth of the

world's people consume an astonishing 86 percent of all goods and

services, while the poorest fifth consumes one-percent.

- 32 percent of the population in

the developing world live below $1 per day (WDI). 2.6 billion people

lack

access to basic sanitation (UNICEF).

- In the last 50 years, almost 400

million people worldwide have died from hunger and poor sanitation,

That's three times the number of people killed in all wars fought in

the entire 20th

century. (BFWI) .

- Each day in the developing world,

30,500 children die from preventable diseases such as diarrhea, acute

respiratory infections or malaria. Malnutrition is associated with over

half of those deaths. (UNICEF, World Health Organization)

|

For global property markets,

the balance of risks is now shifting. With housing markets in about

two-thirds of the world either in or close to a bubble, the impacts of

the coming normalization of monetary policy cannot be taken lightly.

Courtesy of property-induced wealth effects, the global economy was

neatly able to sidestep the potentially devastating aftershocks of a

burst equity bubble. As the liquidity cycle now

turns, the odds are that the world will not be so fortunate the next

time

a bubble bursts. -- Global: Global Property

Bubble? (Part I), MSDW Global

Economic Forum, July 15, 2004. See

also: House of Cards: Survey-Property:The Economist, 29 May

2003. See: Housing and Housing Market Bubbles, NYU, Leonard

N. Stern School of Business.

In The

Spotlight

- House

keeping: Foreclosures Increasing, but homeowners have a lifeline:

"We’ve seen (mortgage) default rates

rise statewide, but an increase in (these) homeowners staying in their

homes," said Julie Fagan, director of the federal Housing and Urban

Development office in Hartford, Connecticut. Homeowners have a variety of

options to help them keep their homes when they have financial

struggles. New Haven Register, 24 January 2005.

- Contingency Planning: National Association of

Housing and

Redevelopment Officials: While home prices have largely kept

pace

with the general rate of inflation in the past, there has been an

unprecedented run-up over the last eight years, with the rise in home

prices exceeding the overall rate of inflation by more than 40

percentage points since 1995. This has created

approximately $4 trillion in bubble wealth - money that would not exist

if house prices had followed their usual patterns. Journal

of Housing and Community Development, October 2004.

- OFHEO

House Price Index Shows Largest One Year Increase Since 1970’s:

U.S.

House Prices Show Annual Rise of 9.36 Percent, September 1, 2004 For additional information, visit

the Office

of Federal Housing Enterprise Oversight News Center.

- How to Report a Complaint about Waste, Fraud, Abuse:

U.S.

Department of Justice. Are you

having trouble making your home mortgage payments? Are you facing

foreclosure

on your home? Get all the facts before you pay someone to help you work

out your mortgage problems. Check out the consumer alert on mortgage foreclosure scams. Gather all the information you need and do

comparative shopping when you need a mortgage. Looking for the Best

Mortgage? A Consumer

Information Brochure will guide you on what you need to know when

obtaining a mortgage.

- Predatory

Mortgage Lending: Current State

Laws || State Legislation || Federal Activities, National

Conference of State Legislatures.

Related Information

- Americans may have mortgaged future on high home

prices: We live in a hot real

estate market (median-priced homes in the Washington area rose 14

percent in 2003 to $286,000 and are up 57 percent since 2000), but we

aren’t all that different. Since 2000, the national median price for

existing homes has increased 23 percent to $170,000, and many gains are

much larger: 31 percent in Boston to $413,000; 64 percent in Los

Angeles to $355,000; 32 percent in Minneapolis-St. Paul to $200,000;

and 74 percent in West Palm Beach-Boca Raton (Fla.) to

$241,000. Robert Samuelson,

Newsweek, 21 April 2004.

- Housebound: According to Warren (Harvard Law

Professor) and

Tyagi over the last 25 years bankruptcies by families have risen by

more then

400 percent, by the end of the decade they project, one in 7 families -

many

headed by college educated professionals will have filed for bankruptcy

- Daniel McGinn, Newsweek, 15

September 2003 (PDF:

Harvard Law School).

- Ending the Foreclosure Crisis: Annual foreclosures

started in Chicago increased 74% from 1993 to 2001, from 4,927 to

8,556. Several community areas on the south and west sides

of the city experienced over a 300% increase in the number of

foreclosures started. There is a similar story from Cleveland where

foreclosures started increased 200% in the past four years. -- National

Training and Information Center. See also Predatory Lending Claims Available to

Borrowers in Foreclosure:

In handling mortgage

foreclosure cases in Illinois, a variety of defenses exist at both

at federal and state levels. The Illinois Technology Center for Law

& the Public Interest.

- Quantifying the Cost of Predatory Lending: U.S.

borrowers lose $9.1 billion annually to predatory lending practices

that include (1) Equity Stripping, (2) Risk-Rate Disparities, and (3)

Excessive Forclosures. A Report from the Coalition for

Responsible Lending, Eric Stein, July 25, 2001. -- Visit the Center for

Responsible Lending, a unit of the Center for

Community Self-Help (Self-Help), based in Durham, NC. Self-Help is one

of

the nation's leading community development lenders and has provided

$1.6 billion

in financing to help more than 24,000 under-served families own homes

or

small businesses.

- Bankruptcy/Mental

Health: U.S. Bankruptcy Court for the Eastern

District of North Carolina's web site.

Consumer Debt: Families In

Crisis

Bankruptcy Statistics: American Bankruptcy Institute

U.S. Bankruptcy Statistics

|

1994

|

780,455 |

1995

|

874,137 |

1996

|

1,125,006 |

1997

|

1,349,510 |

1998

|

1,398,182 |

1999

|

1,290,346 |

2000

|

1,217,972 |

2001

|

1,492,129 |

2002

|

1,539,111 |

2003

|

1,625,208 |

2004

|

820,433

(1st-2nd Quarter)

|

|

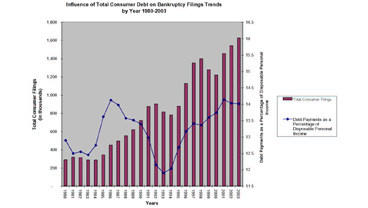

Consumer debt is consistent with bankruptcy filings

Research by the Federal Reserve indicates that household

debt is at a record high relative to disposable income. Some analysts

are concerned that this unprecedented level of debt might pose a

risk to the financial health of American households. A high level of

indebtedness among households could lead to increased household

delinquencies and bankruptcies, which could threaten the health of

lenders if loan losses are greater than anticipated.

|

|

Personal

Bankruptcy Fillings by Quarter

(click

on the image to view a larger version) |

|

|

Households

per Filings,

by State (Ranked)

(click on the image to view as

a PDF file)

|

|

.

.

.

|